GASB 103: Financial Reporting Model Improvements

The Governmental Accounting Standards Board (GASB) has approved Statement No. 103, Financial Reporting Model Improvements, which will become effective for governments with fiscal years beginning after June 15, 2025, and for all reporting periods thereafter. The financial statement improvements resulting from GASB 103 include:

- Changes to Management’s Discussion and Analysis

- Presentation of major discretely presented component units

- Reporting extraordinary and special items as unusual or infrequent items

- Changes to the proprietary statement of revenues, expenses, and changes in fund net position

- Definitions of operating and non-operating revenues and expenses

- And the presentation of budgetary comparison information

Changes to Management’s Discussion and Analysis

The key change to the Management’s Discussion and Analysis (MD&A) is an enhanced focus on understandability and analysis and to avoid “boilerplate” discussions. Specifically, the MD&A should be written in a way that is understandable to users who may not be knowledgeable in governmental accounting and financial statement reporting, including providing additional details to help users understand the information provided. Charts, graphs, and tables will continue to be useful tools in providing clear information to readers. The MD&A should also help users understand why balances and results reported in the current year’s financial statements changed from the prior year rather than simply presenting the amounts or percentages by which they changed. Another key change to the MD&A is to eliminate the duplication of information by referencing the original discussion of an item rather than repeating the same information and analysis previously presented.

The required elements of the MD&A have also been reduced from eight to five sections with the names of some of the sections changing as well. The five sections are:

- Overview of the Financial Statements

- Financial Summary

- Detailed Analyses

- Significant Capital Asset and Long-Term Financing Activity

- Currently Known Facts, Decisions or Conditions

Other key changes include:

- Governments that use the modified approach to report infrastructure should no longer include information about that approach in the MD&A. Instead, that information should be included in the notes to the Required Supplementary Information (RSI).

- The analysis of budgetary variations for the general fund has been removed from the MD&A and should now be included in the notes to the RSI.

- In the Detailed Analyses section of the MD&A, analyses of the financial position for governmental and business-type activities should be included, as well as any significant policy changes (such as tax rates or fees) and important economic factors that significantly affected operation results. Also, here should be an analysis of each major fund’s results of operations and fund balance/net position. The major fund analysis should include why amounts changed from the prior year, and any facts, decisions, or conditions useful to financial statement users.

- As part of the analysis for both capital asset and long‐term financing activity, governments should include intangible assets and the related liabilities associated with leases, subscription‐based IT arrangements, and public‐private and public‐public partnerships.

- The Currently Known Facts, Decisions or Conditions section should include significant expected changes to the budgetary fund balance or net position as a result of a newly adopted budget. To comply with this requirement, governments should be mindful to not include projections but to report events as they have happened through the reporting date. Also, governments using a budgetary basis such as the cash basis or modified cash basis will now be required to track the differences between the budgetary basis and the GAAP (Generally Accepted Accounting Principles) basis fund balance or net position.

Presentation of Major Component Units

For presentation of major component units, governments are no longer allowed to report condensed financial statements in the notes to the financial statements. Each major Discretely Presented Component Unit (DCU) is to be presented in the government-wide financial statements, as long as the readability of the government-wide financial statements is not reduced (combining statements after the fund financial statements is allowed).

Unusual and Infrequent Items

Governments will no longer report extraordinary or special items but instead, will report on items that are unusual or infrequent (definitions unchanged). Specifically, in the ‘flows statements’, any unusual or infrequent items should be reported as the last items before the net change in net position, fund balance, or fund net position, as appropriate. Also, unusual or infrequent items should not be netted together but be presented separately on the face of the flow statements. In the notes to the financial statements, the program, function, or identifiable activity associated with each unusual or infrequent item displayed on the financial statements should be disclosed along with whether the item was within the control of management.

Proprietary Funds Statement of Revenues, Expenses and Changes in Net Position and Statistical Section

In the Proprietary Funds Statement of Revenues, Expenses, and Changes in Net Position, GASB has defined what constitutes a nonoperating revenue or expense. The following transactions are classified as a nonoperating revenue or expense:

- Contributions to permanent and term endowments

- Financing related revenues and expenses (for example, interest expense and lease revenue)

- Proceeds from the disposal of capital assets and items reported as inventory

- Investment income and expenses, and

- Subsidies received and provided

Subsidies are defined as follows:

- Resources received from another party (such as a grantor) or fund that are not related to the goods or services the proprietary fund provides and keeps the fund’s current and future fees or charges lower than they would be without the resources

- Resources provided to another party or fund that are not related to the goods or services provided by the other fund or party and which the fund’s current and future fees or charges are designed to recapture

- All interfund transfer in and out

All noncapital subsidies, which are nonoperating revenues, are to be reported separately, in detail, after operating income (loss) but before all other non operating revenues and expenses.

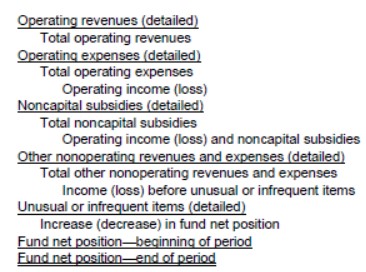

Governments will be required to display the new line items in the statement of revenues, expenses, and changes in net position. Below is the example taken from the standard:

For financial statements issued by governments that conduct only business‐type activities or only business‐type and fiduciary activities and that prepare a statistical section, the financial trends information should be updated to reflect the changes made to the statement of revenues, expenses, and changes in net position. The revenues should be presented by major source distinguishing between operating revenues, noncapital subsidies, and other nonoperating revenues.

Budgetary Comparison Schedules

Under GASB 103, the mandatory budget comparisons for the government’s general fund and major special revenue funds are only reported as RSI. It is also now required to have a variance column between the original and final budget amounts. The notes to the RSI should provide an explanation of any significant differences between both the final budget and the actual results and original and final budgets.

If you have any questions regarding how GASB 103 affects your MD&A and financial reporting, please contact a member of your audit team.

Connect With Us

Stay Connected!

Sign up to receive information on the latest government and non-profit industry insights, firm news, and upcoming events & seminars.